FinTech Alliance SaaS Solution Marks Change in Korean Finance Market

12CM partners with Korea’s biggest cloud service provider, Naver

Business Platform, to launch cloud-based FinTech solution, expects change in

the domestic FinTech market landscape

12CM’s Jeong

Gyoun Han, CEO, announced that the smart stamp software platform provider has

recently inked a collaboration deal with Naver Business Platform (NBP). NBP is

a fully independent subsidiary company of Naver Corporation specializing in

cloud IT infrastructure and services (Naver being Korea’s largest search engine

as well as operating LINE, the #1 chat service in Japan, Taiwan, and Thailand.)

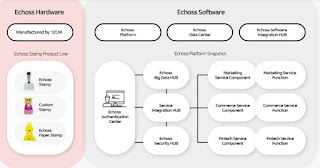

The deal will see the Echoss Stamp developer’s Open API and Finance Microservice

implemented in a FinTech SaaS solution aimed at financial institutions.

Traditionally,

such financial services have required strict security measures making

cloud-based service development difficult. The fact that cloud technology makes

use of a wide variety of frameworks and open source code means that financial

institutions have found adoption of these technologies less than ideal. smart stamp manufacturer

That being

said, NBP is the first cloud operator in the S. Korean domestic market to

receive top marks from the Financial Security Institute for infrastructure

security. 12CM itself will be providing its service security level protocols,

developed and tested over years of R&D and real-world applications, to this

collaborative partnership.

Large

financial institutions already offer a variety of remote services, such as

mobile apps and over-the-phone consultation. However, moving these to the cloud

will allow not only faster implementation of entirely new service channels

(such as mobile web apps) but also alliance service channels enabling

cooperation. The collaboration between 12CM and NBP is slotted to provide a

home in the cloud to accommodate these innovative new services. loyalty card supplier

“The recent

trend of financial institutions moving towards ‘non face-to-face’ services means

that FinTech is in a state of constant innovation. Like financial institutions’

websites, the demand for convenient financial service via diverse cooperation

channels is always increasing. NBP and 12CM are planning to provide a SaaS solution

that emphasizes security and flexibility in financial services to the market as

soon as possible,’’ announced Sang Young Han, director at NBP.

Meanwhile,

12CM CEO Jeong Gyoun Han stated, "For our initial loan service model, the

whole process including security, identification, Open API integration, as well

as certificate submission will be structured as a complete self-contained service.

The SDK itself will also be provided in order for users to customize their own

mobile web pages. For a smooth and successful launch, in addition to our

alliance with NBP, we have also tapped UniFinTech Corp., a consulting company

specialized in mobile commerce and IT."

It is a fact

that there is a global trend of more and more software companies moving onto

the cloud, and while doing so adopting more SaaS or other “as a service”

business models. This Fintech service alliance in the Korean domestic market

marks the next step of mobile evolution in the finance IT industry, and we look

forward to what it may mean for the future of Fintech.

Comments

Post a Comment